Mommy and Daddy’s Money Goes to the Safari Park

This is adapted from a piece I wrote for JMO Research in 2012. It is an illustration of what happens to you and your money when you buy or sell listed stocks through a discount broker who advertises no fees and no commissions. Should you have questions about the current state of affairs of the “Safari Park” after reading my paper, you can find the most updated insights in this week’s Barron’s article https://www.barrons.com/articles/sec-chief-gary-gensler-stock-market-51630626032?mod=djem_b_magazine_20210904

September 7, 2021

By: Jeff Banfield

This article is presented to you as a fictional story. However, suppose you substitute the words in “quotations” with the (bracketed words) provided. In this case, it will resemble the cold, hard truth of what High-Frequency Traders, the Stock Exchanges, and primarily, but not exclusively, Discount Brokers like Robinhood are doing to/with your hard-earned money today.

“Once Upon a Time” (Before the introduction of online trading), there were only a couple of “Safari Parks” (stock exchanges like the NYSE, NASDAQ, and others). These “Safari Parks” had lots of “customers” (orders to buy or sell stocks). The “customers” went there because the “Safari Parks” had mean “Park Rangers” (Floor Governors who enforced the rules of the exchange and protected the public) that didn’t take @!#* from the “predators” (professional traders). You see, the “Safari Parks” were not for-profit back then; they just wanted to protect their “customers” (orders to buy or sell stocks). One day, the “Safari Park Owners” (investment banks who owned the exchanges) decided they didn’t want to own the “Safari Parks” anymore, and they sold their ownership to the public. The “Safari Parks” now had CEOs who needed to show profits were growing.

At the same time, new “Electronic Safari Parks” (dark pool exchanges or privately owned cyber exchanges) appeared. Ironically, some were built by the brokerage companies who had sold their interest in the original “Safari Parks” (stock exchanges like London Stock Exchange, NYSE, and NASDQ). These “Electronic Safari Parks” were also trying to convince “customers” (orders to buy or sell stocks using your money) to visit them.

What followed next was pure corrupt greed.

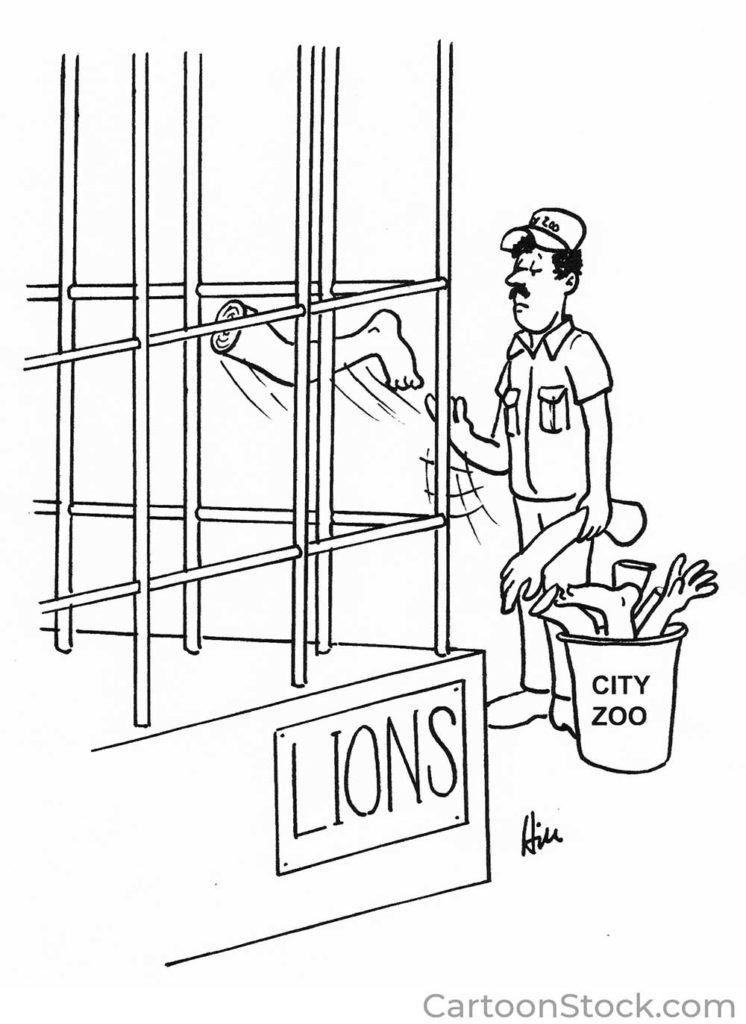

First, the “Safari Parks” figured out that the easiest way to raise profits was to cut unnecessary costs. So, they reduced/fired “The Rangers” who didn’t allow “The Predators” to bend the rules. Customers had always trusted “Safari Parks” because their “Rangers” kept the “Predators” in check. With the introduction of direct online trading for individuals, the “Customers” were given all-access passes to the “Safari Parks.” They were unaware that the doors to the Lion’s Den were left open.

Laws of the jungle; when there is easy prey, the Lions move in.

The “Lions” (well-financed, technologically advantaged High-Frequency Traders with the moral compass of Attila the Hun) called the “Safari Park” CEOs and proposed an idea. If the “Safari Park” CEOs would provide the “Lions” with a little “taste of each Customer” (the difference in the price a customer’s order should have paid for shares and the actual price it paid), then they would reward the Safari Parks CEOs with “Priority Access Fees” (billions of dollars to see each order before it reached the Stock exchange). Keep in mind; the bites were so tiny that the customer would never notice.

The “Safari Park” CEOs determined that no one could stop them since they had fired all the tough “Rangers”. So, the “Safari Park” CEOs agreed to pimp out their “Customers” to the Lions. The bonuses were so good, that the Safari Park CEOs wanted to increase their take, so the “Safari Parks” started to make “Teaser Films” (marketing documents of their customers’ orders getting fleeced by High-Frequency Traders). The “Teaser Films” were used to attract more “Lions” (Professional, well-financed, technologically advantaged traders). The Safari Park CEOs also knew that the key to getting more lions paying them was to attract more “Customers” (orders to buy or sell shares).

Why Stop Now?

So, the Safari Parks sent invitations to the people who sent them the best customers, the “Tour Operators” (The Online Brokers). The “Tour Operators” had been making consistently less money in order to stay competitive with lower “Entrance Fees” (stock commissions) for “Customers” to go to the “Safari Park.” A “Discount Tour Operator” (Electronic Discount Broker like Robinhood) was the most sought after of all the “Tour Operators” because “The Discount Tour Operators'” “Customers” (orders to buy or sell shares) were slow and naive and didn’t notice the little “bites” (the difference in price an order should have paid and what it actually paid) taken out of them. For more than a decade, The Safari Parks and their CEOs, the Lions, and the Tour Operators have made money like Putin’s oligarchs on this racket. They have taken BILLIONS and BILLIONS of dollars from “Customers” (orders to buy and sell shares) who use “Tour Operators and Discount Tour Operators.”

Today…

As I sit here in 2021 and update my 2012 piece; High-Frequency Traders (predatory, professional, fast-trading companies) are paying discount brokers and stock exchanges for the opportunity to see a customer’s order to buy or sell shares before it enters the market. This is otherwise known as Pay For Order Flow. This is nothing short of a racket. Full stop.

FINALLY, on Sept 1, 2021, the Head of the SEC announced that he is looking to abolish or severely restrict the Pay For Order Flow business.

###

For the first 11 years of my career, I worked as a Professional Proprietary Trader at two different investment banks. In all 11 years (1986 to 1997…including the crash and 1991-1993 recession), the proprietary operations never had a losing year, which was considered rare. In fact, we never had a losing quarter. We did have the odd week or month where we lost money, and sometimes it was in the millions. HOWEVER, we abided by the rules set out by the floor governors and securities commissions.

We never paid for order flow. It was then and still is illegal to act on the knowledge of a customer’s order if it disadvantages that customer as a professional trader. The practice is called FRONT RUNNING. https://www.investopedia.com/terms/f/frontrunning.asp

Imagine a company that trades in stocks every day, paying hundreds of millions in fees to trade, and still ends up making unbelievable profits. This sounds eerily like a casino with rigged tables.

“If you’ve been playing poker for half an hour and you still don’t know who the Patsy is, you’re the Patsy.”

Warren Buffett

These firms exist and are the High-Frequency Professional Trading Companies (or Lions in our Safari story). These HFT companies claim to provide the “customer” (order to buy or sell stock) with better prices than they would obtain on their own.

This is simply NOT TRUE!

Here are the facts: The “Lions” (HFT companies) are wedging themselves in between the “customer” (order to buy/sell stock) and the safari park (old fashioned safari park or the newer electronic dark pool safari parks), to skim a vig off each order. If they were eliminated, the order would be processed at the lowest/highest price available, thereby allowing the end customer to pocket the savings or profit and not the HFT co.

They have rigged the game.

Read Flash Boys by Michael Lewis (author of Moneyball and The Big Short). Then contact the securities regulator in your jurisdictions and tell them this must stop.

###

To receive Caravel Capital’s monthly letter, please send an email to: marketing@caravelinvest.com.